Instructions to file forms W2 using TaxMe's excel template.

These instructions apply only to line items specific to TaxMe's excel templates used to electronically file forms W2. Adhere to these instructions in order to successfully upload your file.

General.

- All yellow cells are required fields.

- Type or PASTE VALUES only. Do not link values from external files into the template or paste FORMATS.

- Click on the data headers for additional information.

Employer and employee names.

- Names must not exceed 40 characters.

- DUPLICATE names are not allowed.

- Avoid all punctuation marks.

- Capitalization is not important, system will CAPITALIZE all entries.

- List EMPLOYEE names with FIRSTNAME LASTNAME format. ie: John Doe. Middle names are optional.

Employer Identification Numbers and Social Security Numbers.

- The EIN must include all hyphens and must be in format ##-#######

- SSN's must include all hyphens and must be in format ###-##-####

Addresses.

- Street addresses must not exceed 22 characters.

- City names must not exceed 22 characters.

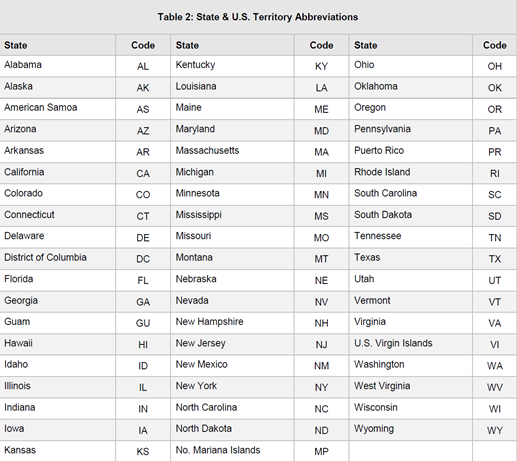

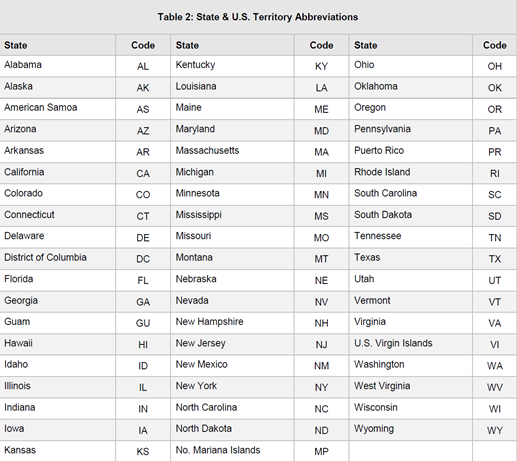

- State two letter codes must be one in the list below (click image to expand):

![]()

×

- Employee state ID numbers must be included for each employee in order to appear on the W2 form. Employer's state ID numbers are assigned by their individual state.

- Zip codes must be 5 digits long.

Kind of payer.

- 941 Select this option if you file forms 941 and no other category applies. A church organization should check this box even if it is not required to file forms 941 or 944.

- 944 Select this option if you file form 944 and no other category applies.

- Hshld emp Select this option if you paid household employees not included on forms 941, 943 or 944. Report Social Security and Medicare wages only if greater than or equal to $2,700.00 (for 2024). Federal withholding is not required unless consent is given. See IRS publication 926 for more information.

Kind of employer.

- Regular Select this option if none of the following categories apply: 501c non-govt, State/local non-501c or Federal govt.

- 501c non-govt Select this option if you are a non-governmental tax exempt section 501c organization. Types of 501(c) non-governmental organizations include private foundations, public charities, social and recreation clubs and veterans organizations.

Authorized by.

- By typing your name on this cell you are authorizing Tax Me, LLC., to file your return electronically and agree to the following perjury statement: Under penalties of perjury, I declare that I have examined this information and the instructions provided and, to the best of my knowledge and belief, they are true, correct, and complete.

Title.

- Enter the title of the authorized individual signing these information returns.

Amounts.

- Amounts are limited to two decimals.

- Wages, Tips, Other Compensation Total taxable wages, tips, and other compensation that you paid to your employee during the year.

- Federal Income Tax Withheld Total federal income tax withheld from the employee's wages for the year.

- Social Security Wages Total wages paid subject to employee social security tax but not including social security tips and allocated tips. The total cannot exceed $168,600 (2024 maximum social security wage base).

- Social Security Tax Withheld Total employee social security tax (not your share) withheld. The rate is 6.2% and should not exceed $10,453.20 for 2024 ($168,600 × 6.2%).

- Medicare Wages And Tips Total wages paid subject to Medicare tax are the same as those subject to social security tax (boxes 3) except that there is no wage base limit for Medicare tax.

- Medicare Tax Withheld Total employee Medicare tax (not your share) withheld. The rate is 1.45% without limitation. In addition to withholding Medicare tax at 1.45%, an employer is required to withhold a 0.9% Additional Medicare Tax on any compensation it pays to an employee in excess of $200,000 in a calendar year. Additional Medicare Tax is imposed only on the employee. There is no employer share of Additional Medicare Tax.

- State Wages, Tips, Ect. Total state wages paid.

- State Income Tax Total state income tax withheld from the employee's wages for the year.

Email

- Fill in this field together with the employee's phone number if you would like Tax Me, LLC to email encrypted Forms W-2 in ".pdf" format to the employee. A telephone number is also required (see Phone Number section below).

- We recommend all employers become familiar with the IRS requirements to furnish W-2 returns electronically. Click here to use our consent template.

- If an email is NOT provided for a particular employee, the employee's form will be delivered electronically to the employer's email address.

- WE DO NOT PROCESS PAPER FORMS. All forms will be encrypted and emailed either to the employee's or employer's email address provided in the template file.

Phone numbers.

- For employer, this field is required. Only US numbers allowed, must be 10 digits long.

- For employee, if you provide an email address, you MUST provide a phone number. We require both an email address and a phone number in order to deliver the form electronically to the employee. We use the employee's phone number for authentication purposes.