Recent legislation provides several tax incentives for employers through the payroll tax system. All these relief measures were established by the Families First Coronavirus Response Act (Families First Act), enacted March 18, 2020 and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted March 27, 2020.

The relevant payroll tax provisions in each piece of legislation include:

The payroll credits have three main benefits:

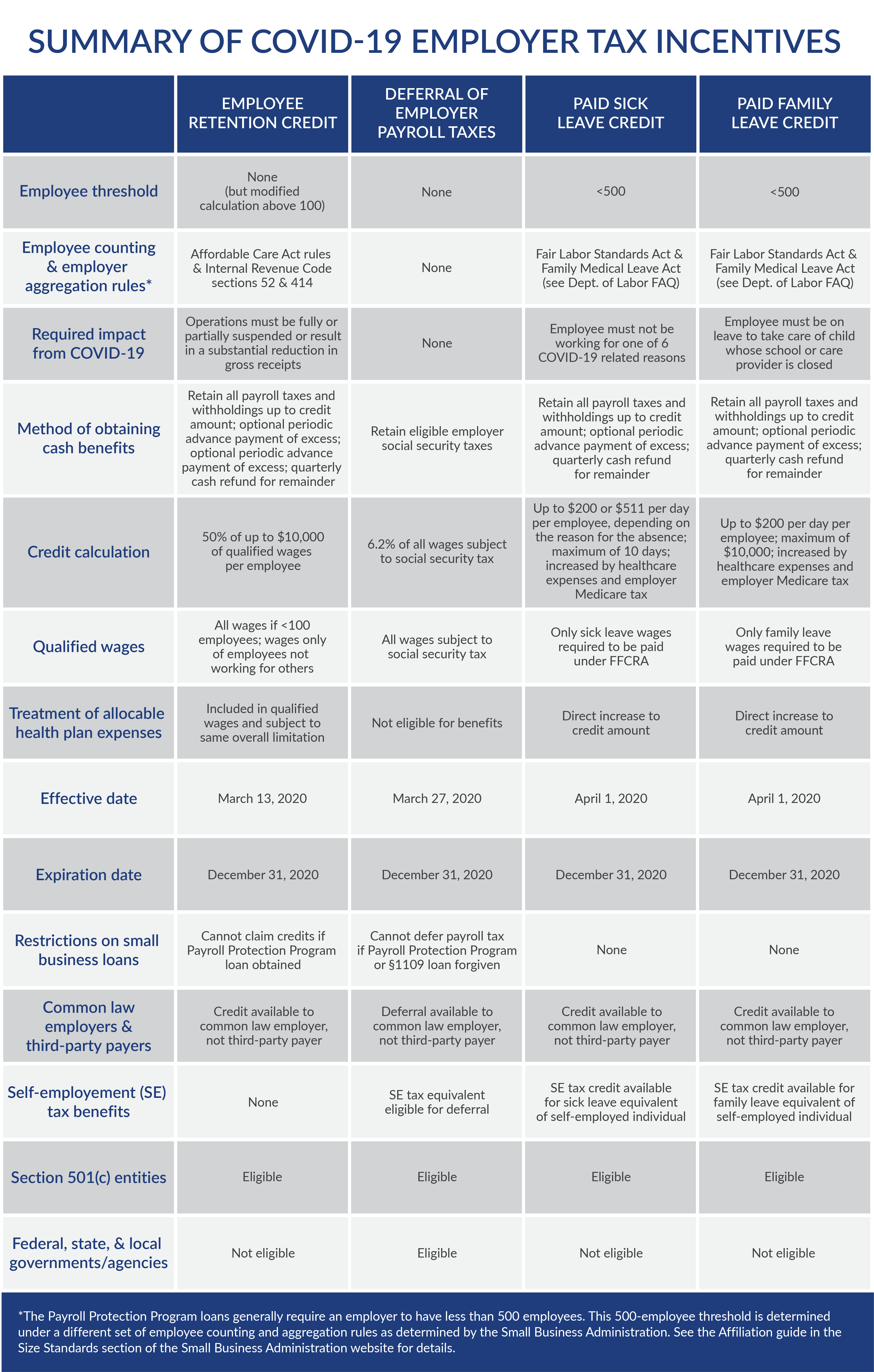

For additional details, please see our previous alerts. In addition, please check out our summary chart at the end of this document.

In the rest of this alert, we summarize key elements of the payroll tax incentive followed by examples.

On April 1, 2020, A takes 12 weeks of leave from his job at X Co. to take care of A’s 12-year old son, whose school has been shut down by COVID-19. A would normally work 400 over a ten-week period, and his regular rate of pay is $24/hour.

For the ten weeks, A is required to be paid at least $16/hour (i.e., $24/hour x 2/3) for the full 400 hours. This is pay of $128/day, which does not exceed the limit of $200/day, and total compensation of $6,400 (i.e., $16 x 400 hours), which does not exceed the aggregate cap of $10,000. Thus, A is paid $6,400 for the final 10 weeks of his 12-week leave.

TIP: With a 40-hour workweek, the maximum hourly rate without incurring a haircut would be $37.50/ per hour (i.e., $37.50 * 2/3 * 8 hours = $200/day). That is, if you pay your employee more than $37.50/hour, then the payment to such employee will be capped by the daily limit.

Continuing the example above, on April 1, B takes two weeks of sick leave from X Co. because her doctor asked her to self-quarantine after being exposed to someone with COVID-19. B’s regular rate of pay is $30/hour. Because this is reason #2 for leave — something is wrong with the EMPLOYEE — X Co. is required to pay B her full rate of pay, or $2,400. Because this amount does not exceed the daily cap of $200/day or the aggregate cap of $5,110, B is paid the full amount.

Increase Credit for Allocable Amount of Health Care & Medicare Example

Building on our continuing example, X Co. is required to pay $6,400 in family leave to A and $2,400 in sick leave to B. Assume that X Co.’s health care costs allocable to those wages was $200. In addition, X Co. pays $127 in Medicare taxes on the $8,800 in wages.

As a result, X Co. is entitled to a credit against its 6.2% share of Social Security taxes on ALL wages paid of $9,127 (i.e., $6,400 family + $2,400 sick +$200 health + $127 Medicare), the exact amount X Co. was required to pay in family and sick wages, payroll tax, and allocable health care costs. Under normal procedures, X Co. would make all of its normal payroll deposits, and when it files its quarterly Form 941, claim a credit and request for refund of $9,127. The IRS intends to update Form 941 beginning in 2020 2Q.

X Co. was in business for all of 2020. From April 1 through June 30th, X Co. had to shut its doors by government order, and its 6 employees were sent home. They were still paid wages of $6,000 each for the quarter. From July 1st through September 30th, the business reopens its doors, but gross receipts are only 30% of what they were for the same period in 2019. The 6 employees are paid $5,000 each for this quarter. From October 1, 2020 through December 31, 2020, the gross receipts of X Co. returns to 85% of the prior year’s 4th quarter.

Because X Co. has fewer than 100 employees, it can count all the wages paid to its six employees for both the 2nd and 3rd quarters of 2020, up to $10,000 each. The credit for Q2 is $18,000 (i.e., 50% * $36,000-which is $6,000 * 6 employees). The Social Security liability was $2,232 (i.e., 6.2% x full salary of $36,000). Thus, X Co. will get a credit of $15,768 (i.e., $18,000 less $2,232 soc sec liability).

For Q3, X Co. will have qualified wages of $24,000 (6 employees * $4,000, because qualified wages are capped at $10,000). The credit is $12,000 (i.e., 50% of $24,000) and the Social Security tax is $1,860 (i.e., 6.2% x full salary of $30,000-which is $5,000 x 6 employees); thus, the remaining payroll credit eligible for refund is $10,140 (i.e., $12,000 less $1,860 soc sec liability).

Thus, between Q2 and Q3, X Co. will generate a total credit of $30,000 (i.e., $18,000-Q2 + $12,000 Q3). Assume that the allocable heath care costs on the qualified wages for each quarter was $2,000, for a total credit of $34,000: $20,000 for Q1 and $14,000 for Q3. Assume further that the qualified wages paid by X Co. were not a duplication of the family and sick leave wages paid in the earlier example.

IR 2020-57 and Form 7200, Advance Payment of Employer Credits Due to COVID-19 allows an employer to:

Building on our previous example, X Co. had $9,127 in family and sick leave credits and $20,000 in total employee retention credits in Q2, 2020. Assume that during the months of April, May, and June, X Co. would have been required to make payroll deposits totaling $40,000: $25,000 in federal income tax withholding on the employees’ wages and $15,000 in employer and employee share of Social Security and Medicare taxes.

Rather than remit payment of $40,000 and then request a refund upon the filing a quarterly Form 941, X Co. may reduce its required payroll deposits by the anticipated amount of family, sick, and employee retention credits of $29,127 (i.e., $20,000 ERC + $9,127 Family/Sick). As a result, X Co. will make only $10,873 of deposits (i.e., $40,000 less $29,127), and have the additional $29,127 available to pay the family and sick leave, as well as qualified employee retention wages equal to the amount of the eventual credit.

However, what if the amount of an employer’s credits exceeds the required payroll deposits? In such situation, an employer who anticipates generating credits in excess of its required payroll deposits may file Form 7200 to request an advance of the refund amount. Form 7200 can be filed at any time during the quarter in which the employer pays wages giving rise to the credits, and it must be filed before the end of the month following the quarter. The IRS has promised to pay the advance refund within 2 weeks.

Example Form 7200 RefundBuilding on our previous example, in Q3, X Co. has no family or sick leave credits, but does have $14,000 in employee retention credits. Assume that the total amount of federal income tax withholding and payroll taxes during the quarter is $12,000. When making its payroll deposits for Q3, X Co. may retain the $12,000 in withholding and payroll taxes and instead use the $12,000 to pay the qualified wages. X Co. is still owed $2,000, however, as the credit of $14,000 exceeds the total of all withholding and payroll taxes by $2,000. At any time during Q3 — or as late as the end of the month following Q3 — X Co. may file Form 7200 to request an immediate refund of the additional $2,000, even before X Co. has filed the Form 941.

LimitationThere is an important limitation between the interaction of the family and sick credits and the employee retention credit: you can’t claim both credits for the same wages paid. Accordingly, if an employer pays $5,000 in sick wages to a taxpayer during a quarter in which gross receipts has dropped more than 50% from the prior year, you are entitled to a sick leave credit, but not also an employee retention credit.

Additional ExampleX Co. had $9,000 in family and sick leave credits and $50,000 in total employee retention credits in Q2, 2020. Assume that during the months of April, May, and June, X Co. would have been required to make payroll deposits totaling $35,300: $20,000 in federal income tax withholding on the employees’ wages, $6,200 in X Co.’s share of Social Security, $1,450 in X Co.’s share of Medicare, $6,200 in the employees’ share of Social Security, and $1,450 in the employees’ share of Medicare.

Rather than remit payment of $35,300 only to later request a refund upon the filing of a quarterly Form 941 of $23,700, ($59,000 credit amount less $35,300 payroll deposit amount) X Co. may reduce its required payroll deposits by the anticipated amount of sick leave credits and ERC of $59,000. As a result, X Co. will not make ANY deposits during Q2, instead retaining the cash for other purposes. Even better, X Co. may file a Form 7200 to request an expedited refund of the excess credit of $23,700. However, see below with a way to increase the refund by the employer share of social security.

In a FAQ issued by the IRS, the Service clarified two key points regarding payroll tax deferral.

X Co. had $9,000 in family and sick leave credits and $50,000 in total employee retention credits in Q2, 2020. Assume that during the months of April, May, and June, X Co. would have been required to make payroll deposits totaling $35,300: $20,000 in federal income tax withholding on the employees’ wages, $6,200 in X Co.’s share of Social Security, $1,450 in X Co.’s share of Medicare, $6,200 in the employees’ share of Social Security, and $1,450 in the employees’ share of Medicare.

Under an alternative, less beneficial interpretation, the IRS could have required X Co. to FIRST reduce its payroll taxes by the anticipated credits. Then, there would be no employer’s share of Social Security tax remaining, and thus no tax to defer. X Co. would be entitled to the same $23,700 refund it received in the previous example.

The IRS FAQ provides, however, that as a first step, X Co. may defer its $6,200 share of Social Security tax until 2021 and 2022. This reduces X Co.’s required payroll deposits from $35,300 to $29,100. Next, X Co. may reduce its required payroll deposits of $29,100 to zero by the anticipated credits of $59,000 (i.e., $50,000 ERC + $9,000 family/sick credits). Finally, X Co. may file a Form 7200 to request an expedited refund of the excess credit of $29,900 (i.e., $59,000 total credit less $29,100)

By allowing X Co. to defer its Social Security obligation BEFORE applying the credits, X Co. has an extra $6,200 available to fund working capital over the coming weeks. Of course, this deferral is just that — a deferral that will eventually be paid in 2021 and 2022. But it amounts to an interest free loan for up to 18 months, which nearly every business in America could benefit from at the moment.

This alert leveraged charts/examples initially published in the linked articles:

https://www.plantemoran.com/explore-our-thinking/insight/2020/04/comparison-of-covid-19-employer-tax-incentives

https://www.forbes.com/sites/anthonynitti/2020/04/01/irs-agrees-to-speed-up-payroll-tax-refunds-related-to-new-covid-19-credits/#493820ce60b9

https://www.forbes.com/sites/anthonynitti/2020/04/11/irs-publishes-faq-on-payroll-tax-deferral-provides-more-immediate-cash-to-businesses/#32b82aac8b7f